Yesterday we initiated with a Buy call and Rp1,800 TP.

Link to our note: A path of gradual recovery

.

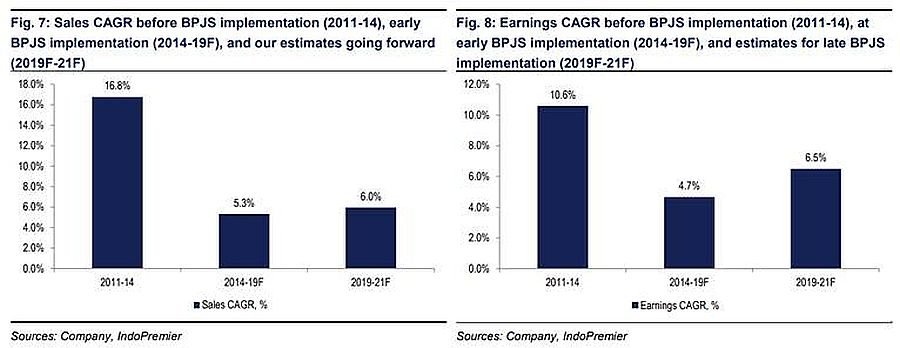

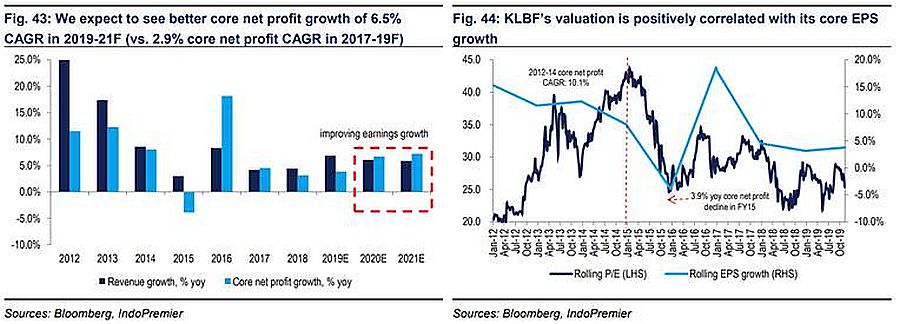

We expect core earnings to improve by 6.5% CAGR 2019-21F vs. 4.7% CAGR 2014-19F, on the back of:

- Stabilizing revenue growth across divisions; we estimate 6.0% revenue CAGR 2019-21F vs. 4.7% CAGR 2014-19F.

- Minimal drop in GPM shall allow better earnings stability.

We see prescription pharmaceuticals' GPM to still decline, albeit at a much slower rate with an average of 20 bps p.a. in 2019-21F (vs. an average decline of 170bp p.a. in 2014-18) as we expect to see unbranded generics' sales growth to normalize, concurrent with the slowdown of the growth of total number of JKN beneficiary.

Rupiah against US$ (which we pencil in at Rp14,200 in 2020F) shall remain stable. We estimate that every 1% rupiah depreciation against US$ will lead to a 30 bps GPM decline in 2020F.

- A&P expenses has trended down since 2016, and is expected to remain at least stable in the upcoming years.

.

While we expect mid-to-high single digit earnings growth to become a new norm, valuation has been falling off-peak of 43.6x P/E since Jan 2015. Currently is trading at 25.9x P/E, or at c.13% discount from its 5-year mean of 29.9x P/E.

.

As 's valuation is positively correlated with its core EPS growth (Fig 44) we think it is likely for to re-rate post-earnings improvement in 2020F onwards. Risk is regulation uncertainty.

Sumber : IPS