Company Update / KLBF IJ / Click here for full PDF version

Author(s) : Kevie Aditya, Elbert Setiadharma

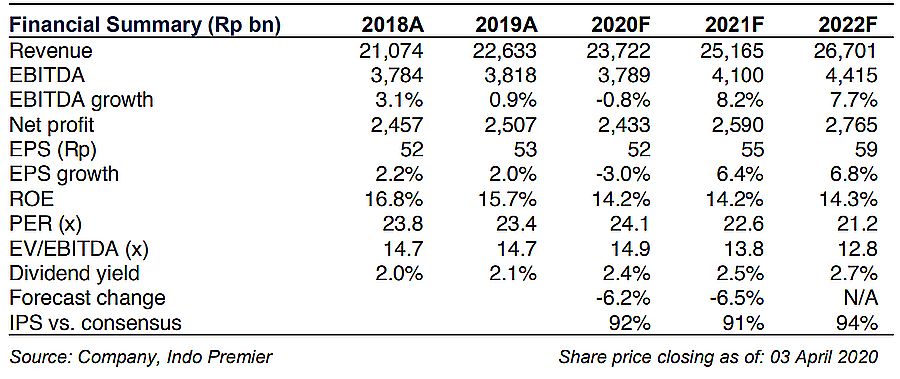

- Adjusting to latest development (Covid-19 and exchange rate), we cut our FY20/21F sales estimates by -1 to -2% and earnings estimates by -6 to - 7%.

- While KLBF may benefit from higher consumer health products sales, it may be offset by weaker purchasing power across other segments.

- KLBF has dropped by 23% YTD which we think has priced-in Rupiah depreciation and EPS risks. Maintain Buy with slightly lower TP.

Audited FY19 results were in-line with indicative results

KLBF 's audited FY19 results were in-line with its indicative results posted on 27 Feb (link here ). It posted -0.9% yoy core EPS drop despite solid revenue growth of 7.4% yoy but mostly from lower margin business which resulted in lower GPM(-140bps yoydue to changes in product mix).Receivables day worsened to 57 days in FY19 (vs. 60days in 3Q19 and 55 days in FY18), which we think will remain in FY20 due to the cancellation of increase in healthcare premium.

What has changed from our latest scenario?

Since Indonesia has reported the first case of Covid-19 on 2 Mar, shopping pattern has changed. Increase in consumer health products sales (i.e. multivitamins, OTC products - paracetamol, flu and cough remedies) is largely expected following rising health concern. However, prolonged Covid19 may lead to a weak purchasing power and disrupting supply chain. We slightly trimmed down our FY20F yoy sales growth estimates to 4.8% from previously 6.4%, now below KLBF 's 6-8% target.

Margin to suffer larger hit from Covid-19 and rupiah depreciation

Logistics for the import of API from China have improved and hence the risk of disrupted production has somewhat subsided, thoughrising API prices is inevitable, in our view.At the same time, rupiah has depreciated by almost 20% YTD to currently around Rp16,600. Using a base case of this year average of Rp15,500 per US$ (from previously Rp13,700), we now estimate a -146 bps yoy GPM contraction in FY20F (5Y low of 45.3%). Low oil price (currently < US$35/bbl) is the only positive thus far.

KLBF shall remain relatively defensive; maintain Buy

Adjusting for the impact of Covid-19, we revised down our FY20/21F EPS by 6-7%. Nonetheless, KLBF 's share price has de-rated by 22.8% YTD; currently trading at 24.1x 12M fwd. P/E and hence, our unchanged Buy call with slightly lower TP of Rp1,400 - pegged to 25.6x FY21F P/E ( or at -1 s.d. below 5-year mean). While we estimate FY20F core earnings to decrease by 3% yoy, we expect FY21-22F core earnings to rebound by 6-7% yoy.

Sumber : IPS