Sector Update / Media / Click here for full PDF version

Author(s): Elbert Setiadharma, Kevie Aditya

- Newly added clause in the Omnibus Law draft may be negative for FTA TV broadcasters, i.e. and .

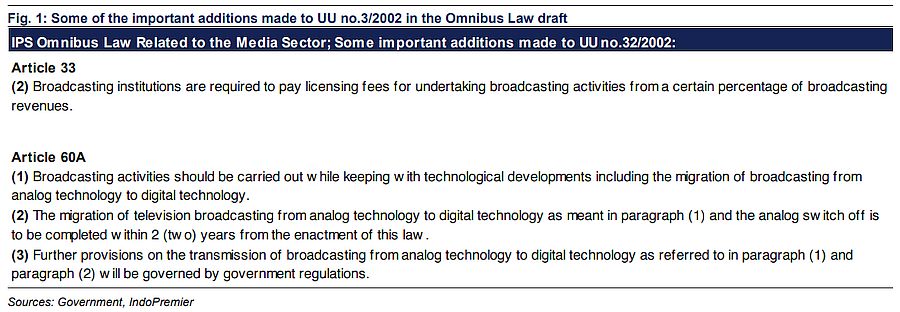

- Article 33 of UU no.32/2002 requires broadcasters to pay a certain % of revenue as licensing fees; formula undecided. Article 60A regulates migration from analog to digital technology within two years.

- Rate card increase and boost from digitals will still allow increase in companies' FY21F earnings, even if we assume 1.5% licensing fees.

Mention of new operating fee scheme in Omnibus Law draft

The Omnibus Law draft encompasses a new clause that was added to Article 33 of the UU no.32/2002, which states that "broadcasting institutions are required to pay licensing fees for undertaking broadcasting activities from a certain percentage of broadcasting revenues." From our understanding, this may refer to the previously reported operating rights fee (BHP) that the government proposed last year in order to increase the sector's contribution to the overall government's non-tax income. This may be similar to the universal service obligation (USO) imposed on the telco sector, which is currently set at 1.5% of revenue. Note that other countries, i.e. Singapore and Australia, have set their broadcasting BHP at a much higher level of 2.5% and 4.5% of revenue respectively.

Possible sizeable impact to earnings for media companies

We expect BHP implementation to happen in 2021F the earliest which shall be negative for bottom line. Assuming the government is going to set the BHP at similar level to telco at 1.5% of revenue (worst case scenario in our view, since media industry size is much smaller than telco), the impact to 's and 's 2021F earnings will be c.5-6% (see Figure 2 and 3).

Migration from analog to digital technology may happen soon

In addition to the changes in Article 33, a new Article 60A was also added to the UU no.33/2002, which will regulate the transition from analog to digital broadcasting technology within the next two years of the enactment of this law. While this may carry some risks of lower barriers to entry causing heightening competition, we are in view that FTA TV competition will remain limited to current incumbents looking at their current dominance.

Impact still unquantifiable with no further details; maintainOverweight

While the impact generally is more negative than positive, we think overall rate card increase and boost from digitals will still allow some solid increase in the companies' FY21F earnings; as it will still imply a +6.3% and +4.1% yoy increase for and respectively even after assuming 1.5% BHP. Recent de-rating (-13% to -14%) within the past month, shall provide better entry point to investors in our view. We maintain sector Overweight and Buy call on both and .

Sumber : IPS