Most developers have just finished compiling its FY19 preliminary marketing sales achievement (although none has officially reported the finalized version). was the only that posted positive yoy growth among big developers .

At the same time, remains the most aggressive going into FY20 as it targets c.10% presales growth to Rp4.4tr in FY20 from Rp4tr in FY19 whereas the rest targets c.5% over its FY19 target (not achievement) - though most haven't officially published its guidance.

On the brighter note, positive presales growth indicated that most developers are pretty optimistic this year as opposed to its flat guidance in the last 3 years. Macro factors will also be on its side (manageable inflation pick-up/lower interest rate/strong currency).

.

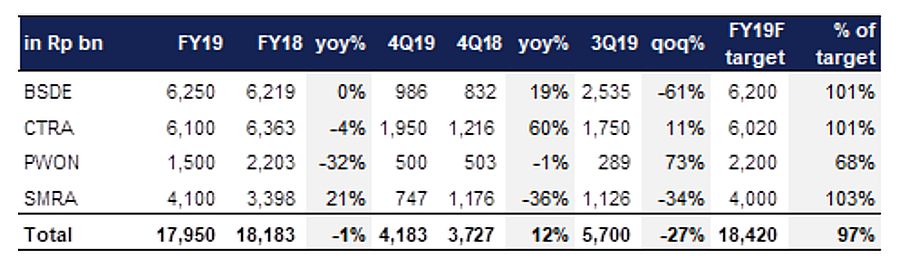

FY19 marketing sales achievement ( was the only that posted yoy growth, while only missed its target)

.

Few highlights of each company:

- : It targets of Rp4.4tr technically should be achievable given its plan to launch Bogor project (totally new project) in June (300-400b presales target) . At the same time, it will continue its successful 2019 strategy to launch more projects with affordable pricing point (thus lower presales target for each launch, i.e. 100-250bn presales target/launch as opposed to previous year's strategy that was aiming of Rp500-700bn presales target/launch). In Feb it plans to launch 4 projects (2 in Serpong, 1 in Makassar and 1 in Karawang).

- : Following the affordable housing trend, continued to sell affordable projects as its main strategy for 1H20. Post Fleekhaus and Imaji Haus, i t will launch Tabebuya with price range between Rp900mn-1.1bn (with 1000 unit available), potentially generating c.Rp1tr of presales . Its 5% target has yet to be finalized.

- : It plans to launch Sentul and Driyorejo (Gresik) in Feb though how much presales it may generated has yet to be finalized. This is positive as they already able to start the launching as early as Feb vs. 2H in 2019 (post election) . 5% target has yet to be finalized.

- : It targets Rp2.4tr presales target for FY20 (+5% yoy vs. FY19 initial target of Rp2.2tr) with the help of the launch in Bekasi that may add another Rp200bn worth of presales sometime in 1Q . Weak presales in FY19 largely attributed to weak sentiment amidst Presidential election overhang that affect its apartment sales. 2020 shall be better in our view as there won't be political noises like in 2019.

Sumber : IPS