- : Dec19 retail is picking up! +ve

- Market Risk-ON

- High Beta Play:

- BUY : Milk It For All It's Worth

.

BOND INFLOW DRIVEN: Strengthening Rupiah continues and now below the 13700 levels, strongest since Feb 2018 as foreign inflows continue particularly in bonds, another $395.6m earlier this week taking YTD inflows @ $1.108bn while equities has also seen ~$230m of inflows YTD

.

: Dec19 auto - manageable inventory and discount amid improving retail demand

Download complete report

Wholesale: Competition is heating up?

National wholesale 4W volume was down 1% yoy (-5% mom) in Dec19. saw sluggish wholesale volume (-10% yoy/-14% mom), largely due to weakness in Daihatsu (-33% yoy/-32% mom) amid competition from other brands, especially in the MPV segment. Non- brands grew 8% yoy (+6% mom), with Wuling (+98% yoy/+137% mom) and Suzuki (+22% yoy/flat mom) being the strongest (it seems like the growth of Wuling is quite staggering. Yet, it is still too early to tell).

Retail volume is picking up + Discount remains manageable

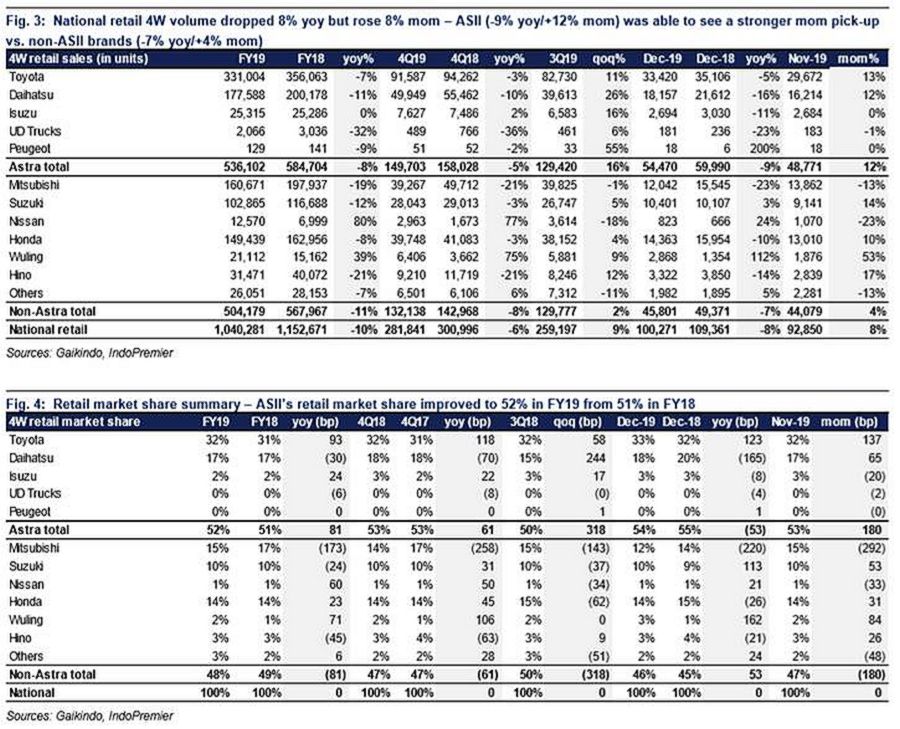

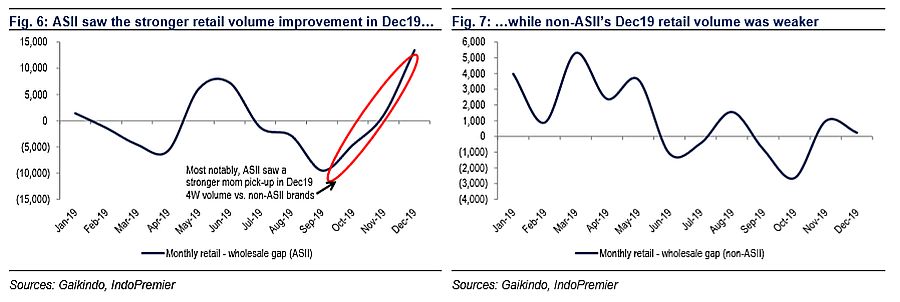

National retail 4W volume was down 8% yoy but rose 8% mom in Dec19 - was able to see a stronger mom pick-up of 12% mom (-9% yoy), largely driven by both Toyota (+13% mom/-5% yoy) and Daihatsu (+12% mom/-16% yoy). Non- brands' retail 4W volume dropped 7% yoy (+4% mom). Cumulatively, national retail 4W volume was down 10% yoy in FY19 - 's was down 8% yoy, while non-'s was down 11% yoy.

.

Good Day Mate! Market seems to be back to risk-on mode

BUY INDONESIA - Indo Premier JCI Target 2020E is 6900

Easing US-Iran Tensions

Positive development on Washington and Beijing Partial Trade Deal

Indonesia gaining FDI momentum i.e. UAE's plan to pump USD22.8bn

Strong IDR Rp13700ish and it still continues. We reckon more and more foreign bond inflow. What about for Equity? Let's wait! Patience is virtue.

Problematic Insurance Company + Pension Fund might hinder this positive development of Indonesia Market. Yet, it is a short term pain for long term gain.

.

High Beta Play if you will

Banks: (1.8)

Consumers: (2.11), (2.04)

Cement: (2.14)

Properties: (2.60), (1.90)

Plantation: (2.58), (2.22)

Other Commodities

(2.65), (3.38)

(2.07), (2.15)

.

BUY : All eyes on monetization

Download complete report

Hans Tantio initiated Telco Sector with OVERWEIGHT Rating. Our TOP PICK is (with BUY TP4400) - ( HOLD TP4400) and ( HOLD TP3300) . Hans argued as penetration matures, telco's focus has shifted to monetizing the customer base rather than expanding market share.

UPDATE:

expects data volume to rise by 15% during holiday season

's management expects that data volume could increase by 15% during year-end holiday, especially in from video/music streaming, instant messenger services, games, and social media. (Investor Daily)

's towers Sales to be finalized by the end of 1Q20

's management cited that tender process is still ongoing at the moment, and expects the sale to be finalized by the end of 1Q20. (Investor Daily)

Other report: Telco: Competition in the youth segment (BUY )

.

Snippets

Government wants to re-calibrate LPG subsidy

Government is planning to optimize the disbursement of subsidy of 3kg LPG to ensure that it is being received by the appropriate recipients. One of the potential schemes being discussed is to limit allocation of subsidized LPG to 2-3 tubes per family per month , to be implemented by 2H20. (Kontan)

confident on achieving 3-4% volume growth in 2020

Management projects a volume growth of 3-4% in 2020 on the back of continuous infrastructure development by the government, domino effect from toll road development to the property sector, as well as further windfall from capital relocation. It allocates a total capex of Rp1.3tr in 2020, which will be mostly used to complete the quarry development project in Jonggol. (Kontan)

will add 200 new EV taxis

is planning to add 200 units of EV taxis in 2020 as part of its plan to expand fleet. Currently, the have operated 29 EV taxis, consisting of 25 units of BYD E6 and 4 units of Tesla X. also has 14 charging stations, with EV operations covering Jakarta, Depok, Tangerang, and Bekasi. (Kontan)

aims for new contract target of Rp65tr in 2020

is aiming for new contract target of Rp65tr in 2020, a 55% increase over 2019 realization of Rp42tr (2019 target: Rp61tr). Management remains confident that projects that were not closed in 2019 could be carried over in 2020. (Kontan)

Pertamina to issue US$10bn global medium term notes

Pertamina plan to issue US$10bn global MTN to fund its capex needs. Fitch rating services give a BBB rating with stable outlook to the company. (Investor Daily)

to issue US$350mn global bonds

plan to issue US$350mn global bonds with 4.25% coupon rate and a tenor of 5 years. The bond issuance will be used to re-finance existing debt and revolving facility amounting to US$300mn as well as its revolving loan amounting to US$200mn. The bond will listed on SGX as well. (Investor Daily)

Sales commentary is not a product of research

Sumber : IPS