IP Report: GIA - Volume or Profitability? You Pick!; Macro - More room for rate cuts; Banks - 10M19 results

- : You cannot get Both World! Either Volume or Profitability? You Pick!

- Macro: Mild Inflation, more room for rate cuts

- Banks: 10M19 results - Lower MoM Provisions TOP Pick

.

: You cannot get Both World! Either Volume or Profitability? You Pick!.

Government is supportive to have a healthier aviation business environment

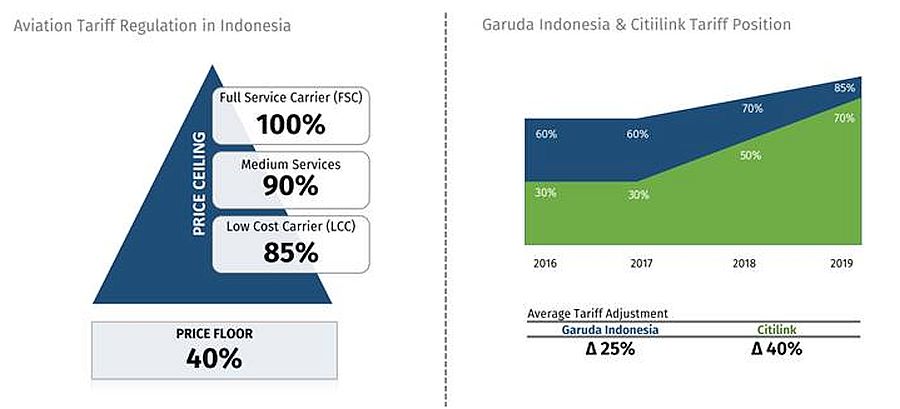

As part of government efforts and initiative to have a healthier aviation business, ministry of transportation introduced Minister of Transportation Regulations 20 Year 2019 that states about Procedures and Formulation of Calculation of Tariff Limit on Passenger Economy Class Services for Domestic Scheduled Commercial Air Transport. This tariff adjustment benefits and the whole industry.

As seen below, 's pricing strategy has set above the price floor. Garuda's pricing it at 85% (from previously at 75%) of price ceiling while Citilink's pricing at 70% (from previously 30%) of price ceiling.

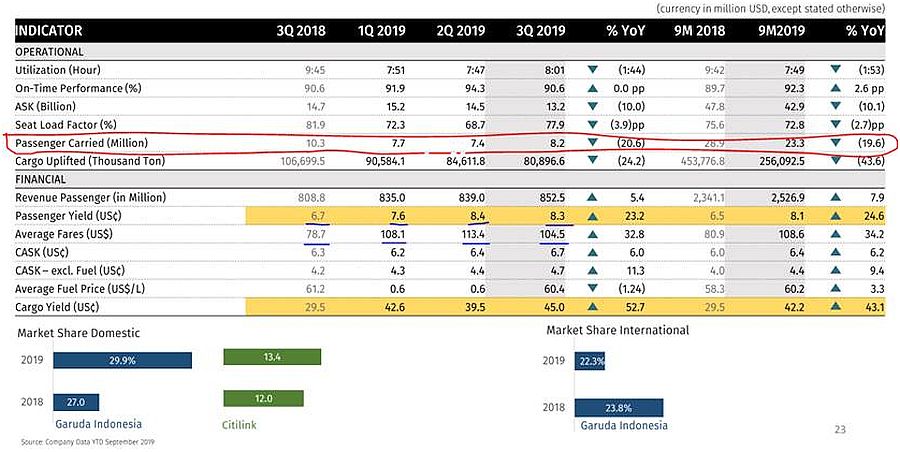

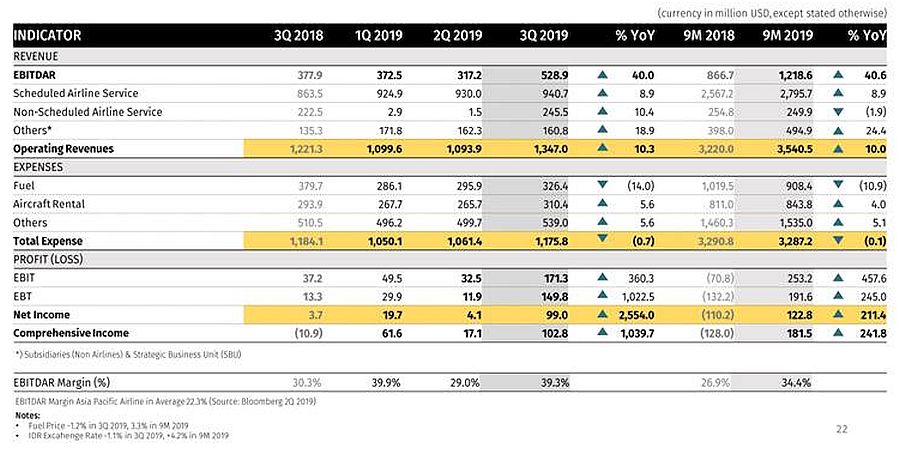

Yet, as result of this price adjustment, both Industry and 's passenger volume in FY19 to decline around 20%ish while profitability to improve due to higher tariff (Industry also printed declining passenger volume growth post tariff adjustment.

.

Some skepticism Airfare is too expensive.

Let us compare this matrix below. I reckon this price adjustment is sustainable.

Both passenger yield and price ceiling comparison are falling on a low side

Cargo is the crown jewel

With the rise of e-commerce, Garuda is positioned themselves to capture this rapid growth of this new economy. Logistic is essentials for E-commerce growth.

Garuda becomes the connector for airfreight shipping. They come up with several initiatives in which they collaborate with logistic companies.

Cargo is one of the business line that they focus to grow

Healthy profitability: Cargo help to expand margin as its NP margin is around 12-15%. This is to balance Passenger business, in which in nature it has lower margin i.e. 5%

Risk of impairment of trade receivables and loss of revenue

Sriwijaya air has decided to separate themselves from Garuda Group. They are no longer part of member of Garuda. What's the implication? Loss of revenue to ? Yes to some certain extent, it will affect Garuda. Yet, eventually it will normalize.

Another thing is the risk of impairment of trade receivables. As we know Sriwijaya Air use service of for their Maintenance Repair and Overhaul ("MRO").

Source: CNN Indonesia

Upside risks?

International flight is still a drag to 's profitability. If it is to be scraped-out, it will be POSITIVE. Domestic business to grow even further

Gaining market share in case of consolidation

Better fuel efficiency

Valuation? For Aviation business PE range from 10-15x

I reckon FY19 Net Profit Target will be around USD100-120m. Hence, Target valuation will range from Rp550-700 per share

*number of Shares outstanding 25.9bn shares

.

Indo Premier Publications:

Macro: Mild Nov inflation, more room for rate cuts

Banks: 10M19 Results / Lower MoM Provision - TOP PICK

.

Snippets

.

allocates Rp1tr for acquisition of second bank

's management cited that it will allocate up to Rp1tr for the acquisition of another small bank, following the recent acquisition of Bank Royal. It indicates that it is close to finalizing its target, though the name of the target bank has yet to be disclosed. (Investor Daily)

System deposit growth at 5.9% yoy in Oct19

Based on BI's data, the banking system's deposit growth stood at 5.9% in Oct19, a slowdown vs. 7% yoy in Sep19. On the other hand, 1-3 month TD rates have continued to trend down by 8-17bp mom in Oct19. (Investor Daily)

aims for Rp500bn from KIK Dinfra

has appointed Mandiri Manajemen Investasi as the designated asset manager for the upcoming KIK Dinfra issuance. The underlying asset will be the Semarang-Solo toll road, with an expected proceeds of Rp500bn. According to the management, they have secured investors for 70% of the issuance (50% are retail). Note that this is a follow up to the previous KIK Dinfra issued in Apr19, where it used the Gempol-Pandaan toll road as the underlying and garnered Rp1tr in proceeds. On the other hand, its plan to issue KIK EBA will be postponed to 2020 due as the administration requirements are still unclear. It expects a total proceed of Rp2tr from the KIK EBA issuance. These alternative funding strategies will help with turnkey payment projects - the next one will be payment of Japek-Elevated II (investment of Rp15tr), which is scheduled for payment end of 2019 or early 2020. (Kontan)

secures of new contract from Africa, aims for Rp5.2tr of new contracts from overseas projects in 2020

has recently signed a contract for construction work of Gore Tower Project Phase 1 in Senegal. The total contract value for Phase I is EUR50mn (equivalent to c.Rp780bn), with a total project value of EUR250mn (equivalent to Rp3.9tr). In 2020, expects to garner c.Rp5.2tr new contracts from overseas projects. (Kontan)

Sumber : IPS