IP Report: Exploring potential affiliated acquisition - Let the dust to settle; Cement - Weak Volume; Coal Production

- Exploring potential affiliated acquisition - Let the dust to settle & LONG the Stock" + Book to read

- Cement: Jan20 Weak Volume

- Coal: Production target might be revised up!"

.

: Exploring potential affiliated acquisition - Let the dust to settle & LONG the Stock

Download complete report

announced its plan for an acquisition of Pinehill Group from affiliated parties.

How big Pinehill group is?

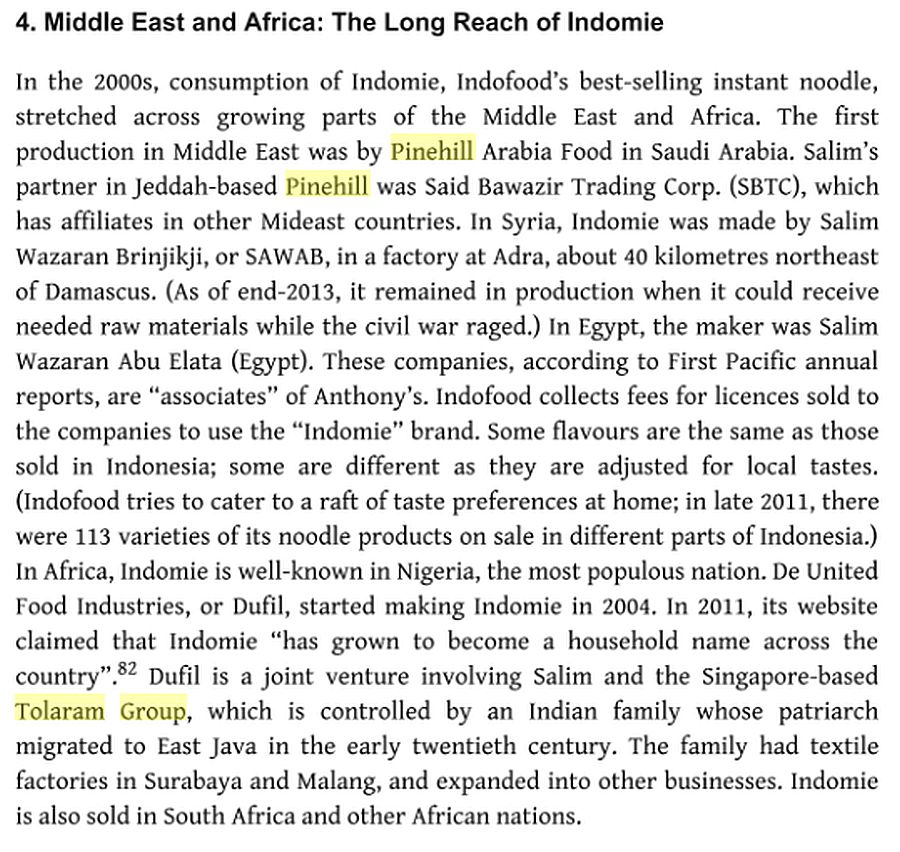

Total sales volume stood at 7.4bn packs of noodle in FY19 (vs. 's around 14bn packs sales volume in Indonesia), with 3-year volume CAGR of around 10%. They are also the most dominant player in all these countries (market share of 50-90%).

Pinehill owns four subsidiary companies and is primarily engaged in the manufacturing of instant noodles in Saudi Arabia, Nigeria, Turkey, Egypt, Kenya, Morocco and Serbia using the "Indomie" trademark under a licensing agreement with PT Indofood Sukses Makmur Tbk ("Indofood"). stated that it will conduct due diligence on the Pinehill group before deciding whether or not to proceed with a transaction.

Pinehill is an affiliate of Mr. Anthoni Salim, the Chairman of the Board of Directors of the Company (the "Board"), a substantial shareholder of the Company, the President Director and CEO of Indofood and the President Director and CEO of and, therefore, a connected person of the Company. If the possible acquisition of Pinehill by were to proceed, the transaction would also be a connected transaction for the Company under Chapter 14A of the Listing Rules, subject to the applicable requirements of Chapter 14A.

What to do with the stock? Learning from the Past.

We recorded three of Indofood Group's latest corporate actions, two of which (Jun 2017 and end-2018) were land acquisitions from related parties. Upon announcement, share price reacted negatively (-5/-7% and -9/-11% for /INDF) in those two instances, although the latter one was short-lived as reported strong 1Q19 revenue and earnings growth soon after. Today we see 6.3% and 8.8% share price decline for and respectively.

Comment: Expect some dip on the back of this news. Related Party Transaction is always deemed negative. Yet, I would take this opportunity to LONG the stock! This is called Inter-related Company financing. Historically speaking, the stock will always bounce back once the dust has settled.

I personally found these two books are very insightful to better understand Salim Group. I really recommend these books below i.e. Liem Sioe Liong's Salim Group by Richard Borsuk and Nancy Chng and the Rhythm of Strategy by Marleen Dieleman

.

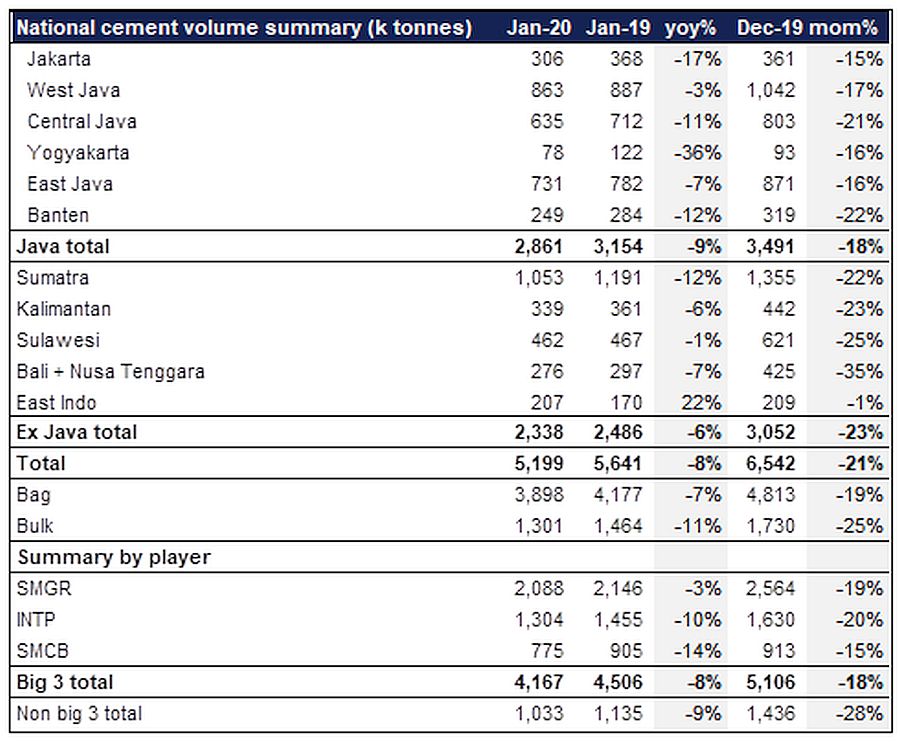

Cement: Jan20 sales volume was weak across area ( -6% yoy/INTP -10% yoy/National -8% yoy

Jan cement volume just came out with overall volume dropped by 8% yoy (national) with dropped by 6% yoy (combined with Holcim) while dropped by 10% yoy, some people argued it was due to flooding but in fact both Java and ex-Java post negative growth .

Some flood and heavy rainfall still persist in Feb so we don't expect a meaningful volume pick-up in Feb. Weak demand, combined with risk of oversupply (attached below) made us skeptical on the prospect of ASP and thus, overall margin .

While we initially thought the drop in stock price for both (-5%) and (-2%) today was purely caused by weak volume, apparently there was another issue that some workers union tried to brought 's CEO past case ('s Saka) to KPK which exacerbated the drop in stock price . We believe this was largely political move and happened regularly ahead of its AGM (next 2 months), so right now we would like to take it with a pinch of salt.

Jan20 sales volume

.

Snippets

Astra will maintain market share in 2020

aims to maintain its market share at c.50% in 2020, assuming national 4W volume grows to 1.05m units in 2020 - in-line with Gaikindo's target. To achieve this target, will continue to focus on adding new products and also improving its after sales services. Toyota Astra Motor has not provided any details, but cited that new product addition will follow customer needs. (Kontan)

Coal production target might be revised up in 1H20

The Ministry of Minerals and Energy Resources indicated that coal production realization could exceed the target set by the government at 550m tonnes. Note that the 550m production target set in the RKAB also already exceeds government's assumption of 530m tonnes based on the non-tax income in the state budget. (Kontan)

allocates capex of Rp7.5tr in 2020

The 2020 capex target is set at Rp7.5tr, slightly lower than 2019's realization of Rp9tr. 80% of the capex will be used to develop infrastructure and network transportation, as plans to fully implement 4G on all its sites and towers - currently there are still c.2000 towers that has not adopted 4G. The remaining 20% of the capex will be used for development of IT system. (Kontan)

B100 program can't just rely on CPO

Government cited that biodiesel as a substitute for solar cannot just rely on CPO, but must also increase the use of environmentally friendly biofuel from other sources such as coconut and castor fruit. On another note, the Asosciation of Biofuel Production Indonesia (Aprobi) is currently focusing on implementation of B40 by end of 2020. (Investor Daily)

Japanese investors look to invest in pharma

Japan External Trade Organization (JETRO) cited that it still hopes for the auto industry, which Japanese is heavily invested in, to see a pick-up going forward. At the same time, it also hopes for growth from other indsutries such as pharmaceutical. (Bisnis Indonesia)

Plaza Indonesia plan a 5% right issue on June 2020

Plaza Indonesia Realty () in talks for 5% right issue or 177.50mn shares from their paid up capital in order to meet the Stock Exchange regulation of 7.5% free float (vs current free float of 4.23%). The potential value of the transaction is at Rp 576.16bn and will be used for company capex. The AGM will be held on 20th March 2020. (Investor Daily)

Pertagas allocates US$280mn for investment

Pertagas allocates US$280mn in the company 2020 budget for pipeline replacement in Rokan Block project to maintain oil production during the management changes to PT Pertamina. The maintenance itself needs US$ 450mn with a total working period of 2 years. To note, Pertagas will work on some projects this year, such as Kuala Tanjung pipeline (North Sumatra), distribution pipeline in Semarang, and Rokan Block pipeline in Central Java. (Investor Daily)

Sales commentary is not a product of research

Sumber : IPS