- Plantation: Are you a Believer of B30? BUY , (+17% UPSIDE)"

- Nickel Px dropped as 9 miners resume ore export - stainless steel px also dips

.

Frederick Daniel, our Plantation Analyst, just attended Indonesia Palm Oil Conference (" IPOC "). Here is his KEY Takeaways:

.

How high can you go?

Our Sensitivity analysis shows at MYR 2700 per ton

1,660 (+18% Upside)

14,900 (+17% Upside)

-- CPO price could increase up to MYR2,700 / US$650 per ton -

***Thomas Mielke, James Fry and Dorab Mistry shared the same view that:

- Palm oil production growth would be lower in 2020

- Deficit would occur (mostly in 1H20), palm oil stock will decrease and price would go up.

- Palm oil price would increase to above MYR2,700 per ton ($650 per ton)

Everything seems like it is dependent on Indonesia's Bio Diesel Policy and Commitment

.

Would price increase sustainable?

-- Depend on govt' of Indonesia's policy on bio-diesel program --

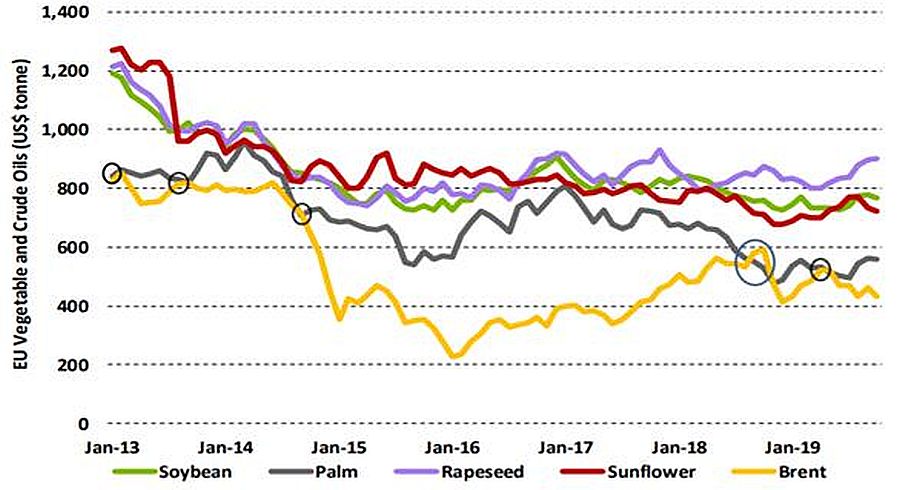

Palm oil price would hit the rock-bottom and increase whenever it drops below Brent oil price. However, with the recent correction in Brent oil price, and palm oil price hike, the gap between palm oil and crude oil expanded.

Fig. 6: Palm oil price would increase whenever it decreases below Brent oil price

Sources: LMC International

Sources: LMC International Thomas Mielke and Dorab Mistry share the same view that B-30 program would not meet its full target (FY20: 9.6mn KL). In 1H20, implementation of B-30 would create deficit in the market and push CPO price higher.

However, as the gap to crude oil expanding, B-30 implementation would be costly which Mielke and Mistry believe would make govt' of Indonesia to reduce blending ratio and consumption of bio-diesel. Thus, CPO price would likely decrease in 2H20.

.

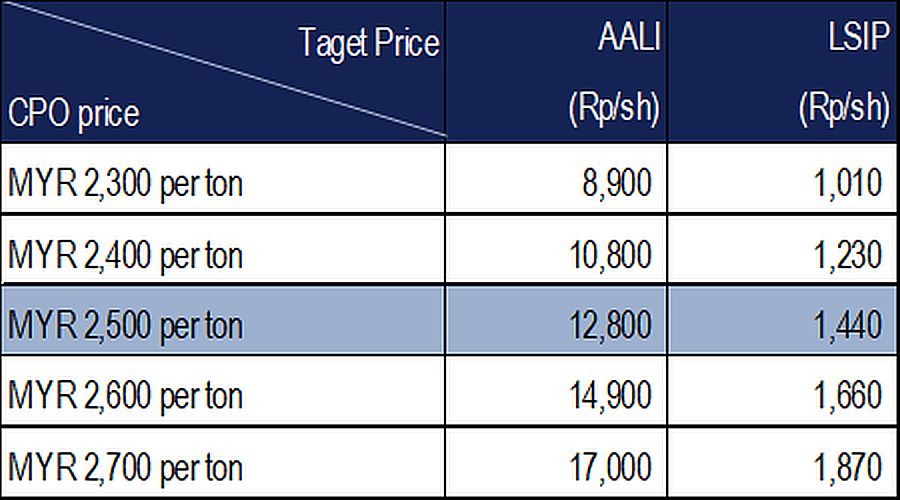

Sensitivity Analysis towards and

An additional MYR100 per ton higher price from the current level would improve 's FY20 earnings by 11.4% and 's FY20 earnings by 20.9%.

We note that currently 's and 's share price reflecting CPO price of around MYR2,500 per ton.

Fig. 7: CPO price sensitivity to 's and 's target prices

Sources: IndoPremier

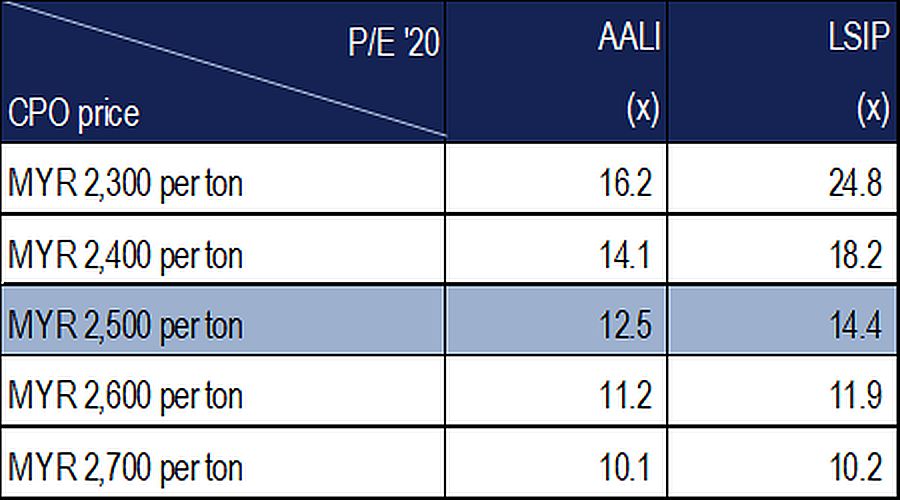

Sources: IndoPremier Fig. 8: CPO price sensitivity to 's and 's FY20 P/E

Sources: IndoPremier

Sources: IndoPremier .

Snippets

- Indonesia clears 9 companies to export Nickel Ore

Indonesia's customs clears nine firms to export nickel ore after briefly suspending shipments for inspection, according to Heru Pambudi, director general of Customs and Excise.

The companies were cleared as audits found no violation of export rules, Pambudi tells reporters in Jakarta on Monday Two more companies are awaiting inspection of their cargoes by officials from ministry of energy and mineral resources, Pambudi says

- targets Rp2.6tn capex in 2020

Sarana Menara targets Rp2.6tn capex in 2020, -26% YoY, from Rp3.5tn in 2019. The capex target doesn't include funds used for acquisition purposes. The company has expressed its interest in participating on 's tower sale. (Kontan)

- boosts industrial land sales

PT Puradelta Lestari Tbk. () is targeting sales of 150ha industrial land this year, currently they had sold 54,7ha of land said ' independent director, Tondu Suwanto. (Bisnis Indonesia)

- Muamalat to seek approval for Rp3,29tr rights issue

Bank Muamalat will ask shareholders on 16 Dec to approve Rp3,29tr rights issue. (Kontan)

- Nickel price dropped as nine Indonesian miners resume ore export

Nickel price dropped more than 3 percent after Indonesia resumes ore exports. Previously, Indonesia suspended nickel mine exports for inspection, and it is expected that China's nickel mine imports will be affected. At present, nine companies are resuming nickel mine exports, and the other two are still facing further scrutiny. (SMM)

- LRT's greater Jakarta line to become operational in June 2021

The Greater Jakarta line of the Light Rail Transit (LRT) will become fully operational in June 2021, said Coordinating Minister of Maritime and Investment Luhut Binsar Pandjaitan. The work to construct LRT's Greater Jakarta line had reached 67.3%, with 86.2% completion of Cawang-Cibubur section and Cawang Dukuh Atas section had reached 53.8%. (Bisnis Indonesia)

Sumber : IPS