Strategy Update Click link to PDF

Author(s): Jovent Muliadi; Timothy Handerson; Anthony

Other than 3Q19 results, most investors that we spoke recently have some concerns on government intervention.

This was a dj vu from the first term of Jokowi's government. We think some has its merits (gas price) while others don't (bank's rate/NIM).

Drop in banks' share price today shall present buying opportunity amid its strong 3Q19 results. We keep our JCI target unchanged.

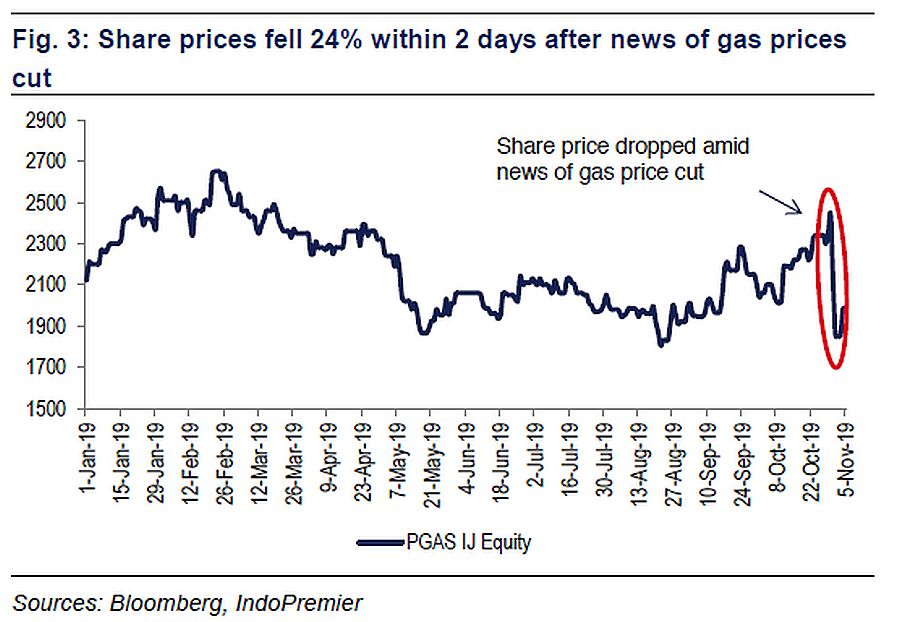

Concerns on government intervention Other than 3Q19 results, most investors that we spoke recently have concerns on government intervention. Most recently: nickel ore ban (earlier than what was previously communicated), gas price (investors was expecting a hike in gas price but Jokowi's ordered a review on gas price, presumably to lower it) and most recently today on banks' lending rate (banks' lending rate needs to come down in-line with BI rate).

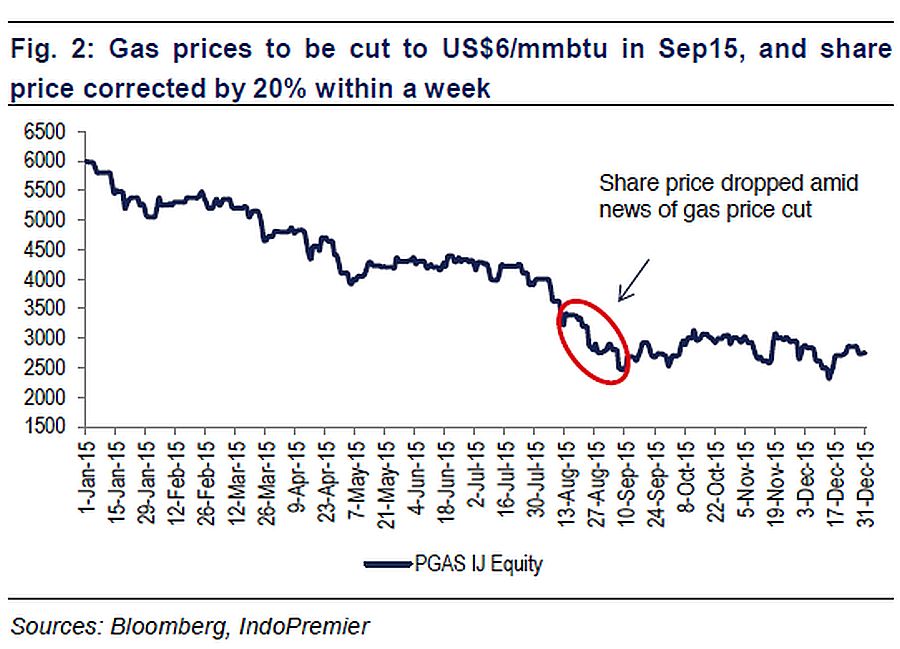

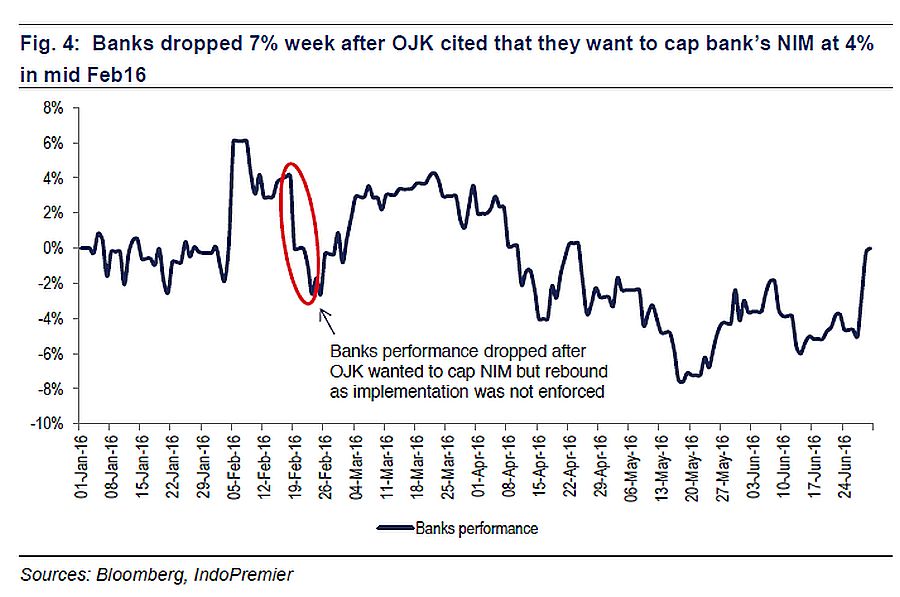

A dj vu for most of the investors This was a dj vu for most investors from Jokowi's first term. During its first term, Jokowi's government did cut cement price (retail bag price back in Jan15), gas price (back in Sept15) and planning to cap NIM at 4% (back in Feb16), though the latter didn't materialize.

Some has its merits.. We think lowering the gas price is possible as: 1) government did cut gas price back in Sep15, 2) gas price is crucial for industry (gas is the 2nd biggest power source for power plant after coal in Indonesia) and by lowering it, government hopes to attract more investments, in our view. Nickel ore ban is imperative as Indonesia needs to start to export a higher value added products to battle its persistent CAD.

..but some don't Nevertheless, we don't think lowering banks' lending rate by force will materialize as: 1) indeed banks' lending rate have fallen (now at 10.7% - down 10bp ytd/-230bp from Mar15), even during period of rate hike in Sep17- Dec18 when BI hiked its reference rate 175bp, lending rates still fell by 75bp and 2) lower BI rate will eventually translate to lower deposit rate (especially TD) which shall naturally lower the lending rate.

Drop in banks' may present a good buying opportunity Most banks (especially the big SOEs) dropped by 3% today, this shall represent a good buying opportunity considering banks' strong 3Q19 results. Bond yield has dropped from 7.5% in mid Aug to 7% now, though JCI and overall banks performance was relatively lacklustre (-5.1% and 3.4%, respectively), we think its performance may catch-up soon. Overall banks still trade at 2.4x P/B and 14.9x P/E (vs. its 10Y avg of 2.3x P/B and 12.4x P/E).

Fig.1: Summary of previous interventions

| Date | Sector affected | intervention | Materialize | impact |

| Jan-15 | Cement | President Jokowi lowered cement prices of by Rp3000/bag | Yes | and share prices dropped 12-13% post announcement week-on-week |

| Sep-15 | Gas | Government for gas prices to be lowered to US$6/mmbtu | Yes | 's share price dropped c.20%post announcement week-on-week |

| Feb-16 | Banks | OJK wants to cap Indonesia bank's NIM at 4% | No | Bank sector's share price dropped c.7% within week of the article |

| Jan-18 | Coal | Government implemented DMO price if USUS $70/tonne | Yes | Coal stocks fell c.7% witihin a week post the announcement |

| Oct-19 | Gas | President Jokowi wants lower gas price | N/A | 's share price dropped 24% within 2 days of the announcement |

| Nov 19 | Banks | President Jokowi wants to lpwer lending rates | N/A | Bank's share price today down 1.3% after the news broke |

Sources: Company, Indo Premier

Sumber : IPS