Company Update / Plantation / IJ / Click here for full PDF version

Author(s): - Ryan Dimitry ;

- 9M24 net profit of Rp803bn (+76 yoy) was above consensus at 79% but in-line with our estimates at 72% (vs. 3Y avg of 70%).

- However, 3Q24 net profit was weaker at Rp206bn (-29% yoy/-37% qoq) due to one-off impairment charges.

- We maintain our Hold call with an unchanged TP of Rp1,100 as faces production issues despite the upside on higher CPO prices.

9M24 net profit was above consensus but in-line with ours

9M24 net profit reached Rp803bn (+76% yoy) above consensus at 79%, but in-line with our estimates at 72% (vs. 3Y avg of 70%). Revenue reached Rp2.9tr (flat yoy) as growth in CPO ASP (+12% yoy) was offset by a decline in CPO sales volume of -8% yoy. Gross profit grew to Rp1.1tr (+70% yoy) as GPM increased to 37% (+1,511 bps yoy) due to higher CPO ASP and lower fertilizer cost (-30% yoy).

Drop in 3Q24 net profit was due to non-operating expenses

Net profit declined to Rp206bn (-29% yoy/-37% qoq) due to higher-than-expected non-operating expenses (impairment charge of Rp139bn and an FX loss of Rp25bn). Revenue reached Rp1.1tr (+8% yoy/+22% qoq) driven by an increase in CPO ASP (+19% yoy/+3% qoq) and sequential qoq improvement in CPO production/sales +9/15% qoq. Gross profit reached Rp469bn (+56% yoy/+36% qoq) as its GPM increased to 42% (+1,282 bps yoy/+424 bps qoq). Its EBIT reached Rp383bn (+75% yoy/+40% qoq) while EBIT margin increased to 34% (+1,305 bps yoy/+445 bps qoq).

CPO production declined along with sales volume despite ASP increase

Operationally, we saw a decrease in CPO production at -16% yoy/+9 qoq to 71kt in 3Q24, FFB production also declined by -12% yoy/+11% qoq to 298kt. FFB yield also declined to 13t/ha in 3Q24 from 15t/ha in 3Q23. In terms of sales volume, CPO sales also declined -9% yoy/+15% qoq to 70kt in 3Q24 despite rising CPO ASP to Rp12.8k/t in 3Q24 (Rp12.3k/t in 9M24) which was up 19% yoy/+3% qoq.

Maintain hold with an unchanged TP of Rp1,100

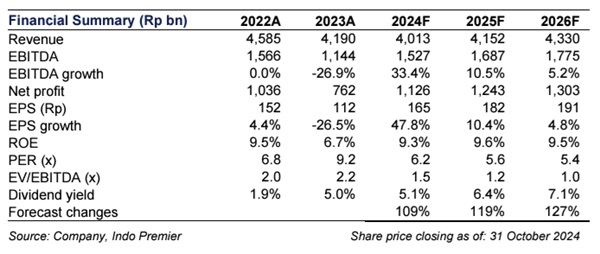

We maintain our forecast with an unchanged TP of Rp1,100, implying FY25F P/E of 6.2x (unchanged at -1 SD of its 5yr mean). We maintain our Hold rating on as we expect the weak production from its ageing plantation profile to continue to weigh down its revenue potential. Risk: CPO output/prices, weather conditions, and regulations.

Sumber : IPS