Company Update / Towers / IJ / Click here for full PDF version

A uthor(s): Aurelia Barus ;BelvaMonica

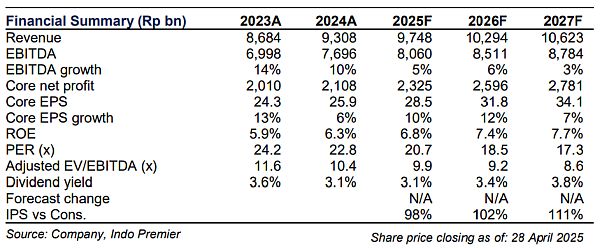

- 1Q25's EBITDA/core NP were Rp1.8tr/Rp526bn (+2%/+1% yoy), in-line with our/consensus estimates at 23/23%.

- In 1Q25, total tenants nett add was 391 with a stable tenancy ratio of 1.52x, within our and company's expectations.

- Retain our BUY call with an unchanged TP. is our sector top pick.

In line 1Q25 results

In 1Q25, recorded total revenue of Rp2.3tr (-9% qoq, +3% yoy). Telco tower lease revenue from the Telkom Group increased by 4% yoy, while revenue from other parties declined by 0.2% yoy in 1Q25. We believe improvement in third-party revenue could take place in the coming quarters. 1Q25 EBITDA stood at Rp1.8tr (-7% qoq, +2% yoy). The EBITDA margin in 1Q25 was 83%. Core net profit reached Rp526bn in 1Q25 (-9% qoq, +1% yoy). Overall, revenue, EBITDA, and core NP in 1Q25 were in-line with our and consensus estimates. Total debt at the end of Mar25 stood at Rp18.2tr, with a net gearing ratio of 0.49x.

Anticipating more tenant additions in the coming quarters

At the end of 1Q25, total towers reached 39.6k units (+4% yoy). Meanwhile, tower tenants reached 60.3k (+4% yoy), with net tenant additions of 391. The implied tower tenancy ratio was 1.52x, remaining stable compared to the end of FY24. maintained its unchanged target of 2.5k net tenant additions for FY25F, anticipating that further tower additions could take place during the year. In line with the unchanged guidance, we also retain our estimate of 2.5k net tenant additions. We maintain our estimates for 40k towers and a 1.56x tenancy ratio. In the fiber segment, as of the end of 1Q25, total fiber length reached 53.5k km (+48% yoy), with a net addition of 2.5k km compared to the end of FY24. We maintain our estimate of a 10k km fiber revenue addition (in-line with the company's guidance), reaching 61k km by the end of FY25F.

Retain unchanged BUY call with a TP of Rp780/sh; sector top pick

We retain our BUY call on with a TP of Rp780/sh, based on 12x EV/EBITDA 12M fwd (-1 s.d. below LT mean). could potentially be a key beneficiary of the XL Smart merger and MNOs' expansion outside Java. Key risks: XL Smart merger outcome, MNO expansion, and worsening macro condition.

Sumber : IPS