MacroInsight / Click here for full PDF version

Author(s): Luthfi Ridho, Desty Fauziah

- BI may likely to take a pause from cutting its policy rate by another 25bp as it has made two consecutive cuts (-50bp) in the last two months.

- Channeling liquidity in the financial sector to real sector is imperative for economic recovery in the 2H20.

- Weak economic activity, benign inflation and the need to inject more liquidity to real sector underpin our projection of another 50bp cut in 4Q.

Cutting too aggressively may induce short-term volatility

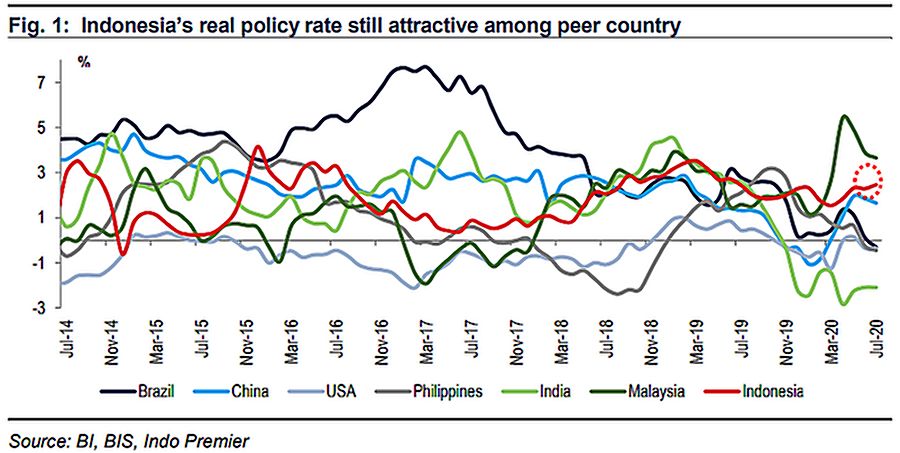

After two consecutive months of policy rate cut (50bp), we believe that BI may take a pause in the next meeting (18-19 Aug); this also necessary to avoid currency volatility (Rupiah weakening by 6.1% mtd). In theory, weakening economic activity (-5.34% yoy in 2Q20, the first contraction since 90s) and declining inflation (+1.54% yoy in July, all time low since 90s) are suffice to justify further rate cut. At the same time, in-terms of interest rate parity, Indonesia policy rate in real terms is still competitive at roughly 2.5% vs India (-2.0%), Philippines (0.5%), Brazil (-0.3%), etc.

Ample liquidity needs to be productive to avoid crowding-out

State-budget financing realization at around Rp500tr as of July (+120% yoy) was much higher compared to state expenditure (+1.3% yoy in July) which may crowd-out the financial sector's liquidity. Concurrently, the government account in BI increased to Rp280tr (+76% yoy/+4% mom) which it should be in declining trend (instead of increasing) as more money being spent for various economic stimulus or health related expenditure. Meanwhile, banking liquidity may not effectively channelled to the real sector as BI's open monetary operation (OMO) increased by 73.6% yoy to Rp536tr while private credit grew less to 1.0% yoy (+6.0% yoy in early 2020). Already, BI stated that accommodative monetary policy is also intended to improve the monetary transmission mechanism to the real sector amid increasing default risk during economic downturn situation.

A temporary pause as room for further cut remained ample

We believe that further monetary stimulus is imperative to induce more economic activity. Hence, we expect further rate cut by 50bp in 4Q20 to help the current situation of weakening domestic demand, declining inflation and low private credit. The risk of lowering the interest rate is Rupiah volatility, but forex reserves reached an all-time high level at US$135bn which shall alleviate such concern.

Sumber : IPS