MacroInsight / Click here for full PDF version

Author(s): Luthfi Ridho, Desty Fauziah

- We estimated that there will be a deflation in June CPI at around - 0.02% mom or 1.74% yoy from cheaper transportation and food prices.

- Rupiah continued to appreciate to Rp14.0k/US$ avg in Jun, from Rp14.7k/US$ avg in May mainly due to drop in oil import (-50% by value).

- With softer inflation and stable currency, we are on the view that BI rate will be lowered further by 25bp to 4.0% in the next meeting.

Large scale social restriction relaxation impact has yet to take effect

In June, price of almost all types of goods are declining. To mention a few, prices of vegetables were cheaper by 0.04% mom in average, prices of transportation declined by 0.03% mom in average and prices of gold jewellery declined by 0.02% mom. We are on the view that the declining price trend was ultimately due to muted impact from relaxation on PSBB (large scale social restriction) and after effect of Eid Festival (lower purchasing power). This may reverse in the coming months, in our view.

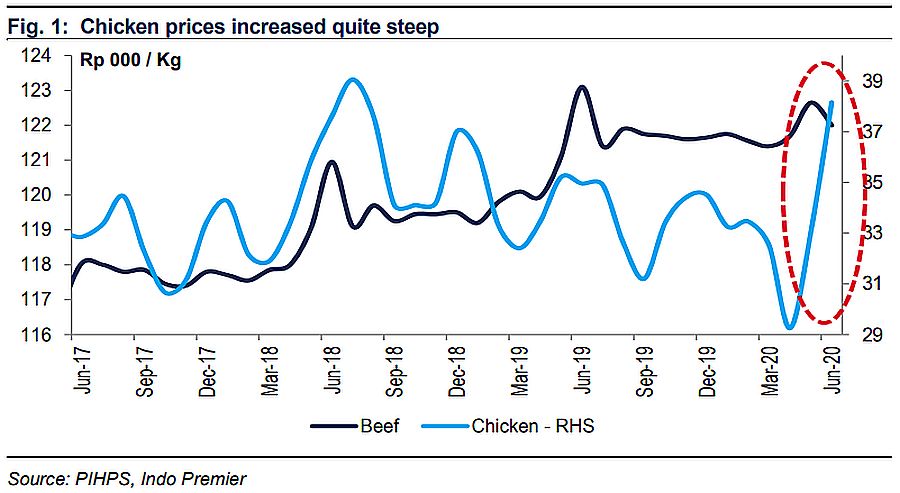

Pick-up in chicken price

Chicken price during June showed an interesting movement as it went up by around 50% and stay elevated until recently. By far, the explanation from government officials suggested that this was from supply shortage as many farmers went out of business (anecdotal evidence suggests around 10-20% of total farmers). Note that chicken prices were on declining trend since the beginning of the year to reach as low as Rp29k/kg - the lowest in the last 7- years. Even during the recent Eid Festival season, the price of chicken declined by around 0.1% mom in average.

BI will likely cut the policy rate by 25bp to 4%

We believe the Rupiah exchange rate will continue to stabilize at around Rp14.0k/US$ largely due to lesser onshore US$ demand following the decline in oil import. Risk to our call is if the foreign flows reversed. Thus, with inflation to remain benign and stable currency, we believe BI may have a bigger room to lower the policy interest rate by 25bp in the next meeting. This in our view may help the overall confidence in the recovery period and at the same time preserving the macro stability.

Sumber : IPS