MacroInsight / Click here for full PDF version

Author(s): Luthfi Ridho, Desty Fauziah

- State revenue were sluggish at Rp220tr in Feb20 (1.7% yoy), while expenditure grew faster at Rp279.4tr (2.8% yoy).

- Fiscal deficit will likely be widened to more than 3.0% GDP (vs. 1.76% GDP in budget), due to more health related spending.

- Widening deficit shall ultimately translate to more economic growth, but just enough to avoid recession, in our view.

Sluggish state revenue realization

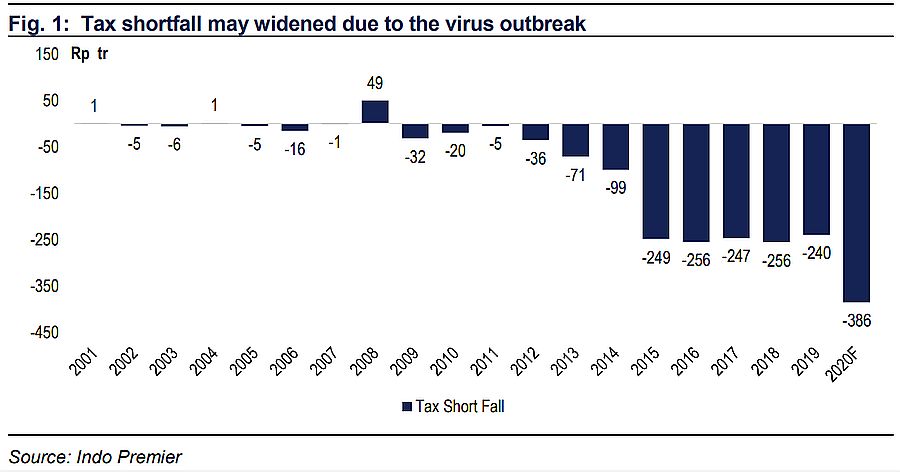

State revenue continue to remain sluggish (+1.7% yoy) at Rp220.8tr in Feb 2020, largely due to sluggish oil related tax revenue (at Rp6.6tr vs. Rp10.5tr last year), but offset by higher other taxes account. In addition, non-tax revenue contracted by 8.0% from last year due to lower oil related revenue. With current macroeconomic situation, the trajectory of the tax shortfall may reach Rp385tr, translating to 3.5% GDP (assume no spending cut and no increase in health related spending). Hence, without a proper plan in the fiscal management, worsening virus outbreak may lead to recession.

Wider fiscal deficit should be suffice to avoid recession

We are on the view that the recent plan to widen the fiscal deficit to 5% of GDP shall be enough to avoid economic recession, as this equals to roughly Rp200tr additional spending. This additional spending may not only cover the health related cost (approx. at Rp100tr), but also provide safety net for the most impacted industries/population (i.e. mid-low end). We are on the view of 3% - 4% economic growth in 2020.

Wider fiscal deficit is not the silver bullet

We must underline that high fiscal deficit is only a temporary solution. In 2021 at the earliest, there should be a tighter measure for the fiscal deficit or else, a solvency problem as tax revenue will be lower under the new omnibus law. In addition, we also think that the financing of the enlarged deficit will be playing a crucial role. If it relies too much on domestic financing it may trigger the crowding-out effect against domestic banks' liquidity. Thus, it should be a mixed financing between multilateral fund, global bonds and Rupiah bonds, in our view.

Sumber : IPS