MacroInsight / Click here for full PDF version

Author(s): Luthfi Ridho, Desty Fauziah

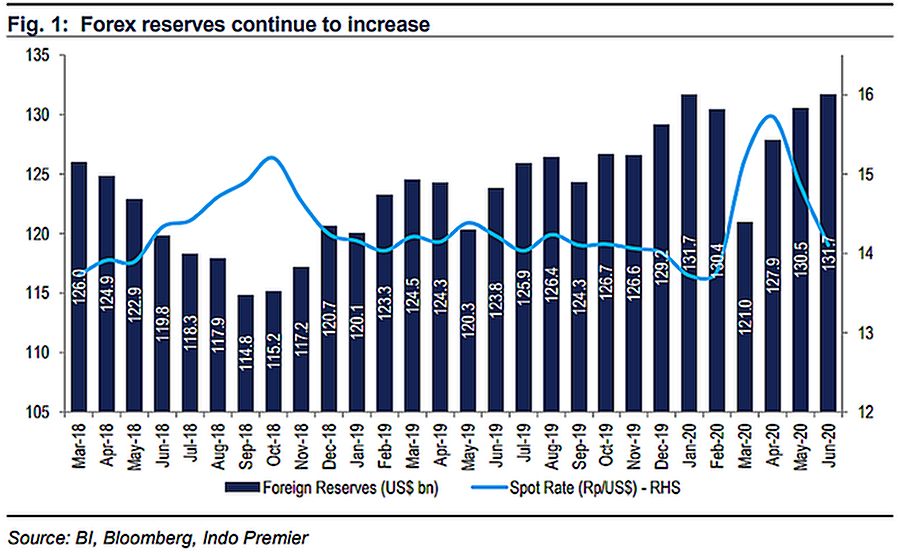

- FX reserve picked-up to US$131.7bn in Jun from US$130.5bn in May, due to global sukuk issuance (sharia-compliant bond) at US$2.5bn.

- Foreign investors recorded a net inflow of US$0.04bn in June, consists of +US$0.37bn in bonds and -US$0.32bn in equity.

- We think that Rupiah will be relatively stable until year-end from drop in oil import value and high FX reserves to cushion volatility.

Indonesia's FX reserve increased by US$1.2bn to US$131.7bn in Jun20

Indonesia's FX reserve increased by US$1.2bn to US$131.7bn in Jun20 (US$130.5bn in May20). The current reserves level is estimated to be equivalent of 8.1 months of imports and government's external debt servicing. This is higher than international standard of 3-months' worth of import and debt servicing. The increase in FX reserves was largely attributed to global sukuk issuance during June amounted at US$2.5bn consisted of: US$750mn for 5y tenor, US$1bn for 10y tenor and US$750mn for 30y tenor.

Net capital inflow in Jun20

Foreign investors booked a slim net buy of US$0.04bn in the domestic financial markets, largely from the bond market at US$0.37bn. On the contrary, the equity market recorded a net sell of US$0.32bn. The inflows were lower compared to the inflow in May20 at US$1.02bn. In addition, in the midst of extremely volatile global capital market, the issuance of global sukuk received a very good response from global and local investors resulting in an order book of US$16.66bn or around 6.7x of its initial target of US$2.5bn.

Stable Rupiah outlook

Our gauge of the exchange market pressure (EMP) suggests that there are no imminent pressures to Rupiah at the moment. Concurrently, oil imports have declined by 10% in terms of volume and by 30% in terms of value as of May which shall alleviate pressure for Rupiah

Sumber : IPS