MacroInsight / Click here for full PDF version

Author(s): Luthfi Ridho ; Axel Azriel

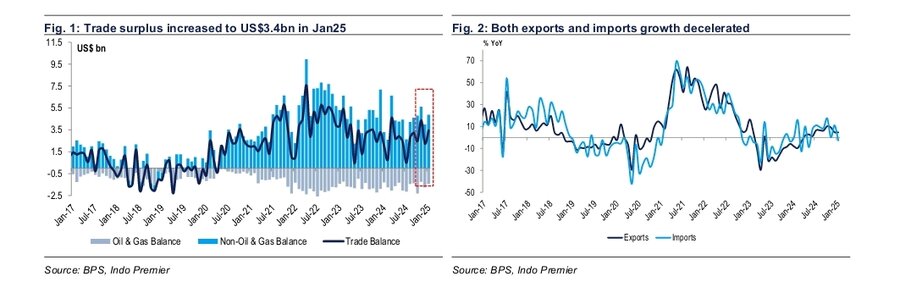

- Trade surplus rose to US$3.5bn in Jan25 (US$2.2bn in Dec24) amid drop in imports at -2.7% yoy (+11.1% in Dec24).

- Electronics exports were the bright spot at +20.5% yoy, but coal and CPO posted negative exports growth at -8.9%/-2.9% yoy.

- We expect higher economic growth of c.5.1% in 1Q25 from consumption due to Eid festivity and gov't policies, e.g. electricity price discount.

Higher trade surplus from contracting imports

Exports inched down +4.7% yoy in Jan25 (+4.8% yoy in Dec24), while imports dropped to -2.7% yoy (+11.1% yoy in Dec24). As a result, the trade surplus widened to US$3.5bn in Jan25 (consensus at US$1.8bn, previous surplus at US$2.2bn in Dec24). Export growth was mainly supported by a rebound in non-oil & gas export at +6.8% yoy (-4.3% yoy in Dec24). While the reversal in imports was primarily coming from a higher contraction in oil imports at -8.0% yoy (-2.2% yoy in Dec24, see our report on oil & gas here). Overall, we see more challenging external trade as the latest commodity price projection from the IMF suggests a contraction of roughly c.-1%.

Electronics and precious metal were the bright spot

Electronics sustained its double-digit growth at +20.5% yoy in Jan25 (+22.1% yoy in Dec24) mainly due to stronger demand for Indonesia's low-value electronics in the USA such as cables, etc. (accounts for 26% of Indonesia's electronics market). Meanwhile, precious metal export recorded stellar growth at +52.2% yoy (-21.9% yoy in Dec24) primarily supported by an increase in gold price at +37.2% yoy (+27.2% yoy in Dec24).

We expect GDP growth of +5.1% in 1Q25

We see the higher trade surplus to be positive for GDP growth at c.+5.1% yoy in 1Q25 (+5.0% in 4Q24). Shall the surplus be sustainable, the external trade contributions to the GDP are likely to be more-than-expected. Moreover, the higher 1Q25 GDP growth expectation will also be supported by bigger consumption due to higher household disposable income from the 50% electricity tariff discount (accounted for around 10-20% household budget) and the Eid festivity seasonality.

Sumber : IPS