MacroInsight / Click here for full PDF version

Author(s): Luthfi Ridho ; Sevi Vinasty

- We estimate lower CPI at +0.21% mom/+4.13% yoy in May23 (+0.33% mom/+4.33% yoy in Apr23) mainly from cheaper transport cost by -40%.

- Rupiah appreciated by +3.9% YTD to Rp14.9k from net foreign inflows (US$5.8bn YTD), but risk may come from higher volatility in mid-year.

- We expect the BI rate to be unchanged at 5.75% in Jun23. However, we see the BI rate to be at c.6% (another +25bp) in 2H23 for macro stability.

Expect weaker headline CPI post Eid festive seasonality

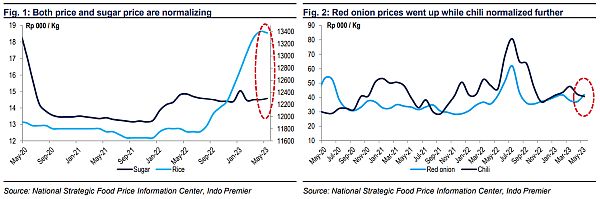

We expect headline CPI to be lower at c.+0.21% mom/+4.13% yoy in May23 (+0.33% mom/+4.33% yoy in Apr23) mainly due to normalizing transportation cost post Eid season. Our price tracker suggests airline fares have declined by c.-40% due to the end of Eid seasonality and further contraction in avtur price at -3.3% mom (-14% YTD in Apr23). In addition, fresh food items showed increasing price trend at c.+2.8% mom/-1.2% yoy in average (vs. -0.6% mom/-2.5% yoy average in Apr23) led by higher garlic price at +9.9% mom/+16% yoy (+1.1% mom/+3.3% yoy in Apr23). On the contrary, beef and chili prices were cheaper by -0.6% mom/+0.6% yoy (+1.1% mom/+3.3% yoy in Apr23) and -4% mom/-11.6% yoy (-11% mom/-12.3% yoy in Apr23). In addition, rice price (the highest weight in inflation category at 4.2%) was relatively stable at -0.2% mom/+13.9% yoy (+0.8% mom/+13.6% yoy in Apr23) as rice supplies are relatively ample at c.500mn kg YTD (+25% yoy) according to Bulog.

Core CPI shall be stable while Rupiah is still strengthening

We estimate core CPI to be stable at +0.35% mom/+2.95% yoy in May23 (+0.25% mom/+2.83% yoy in Apr23) as we see that household purchasing power remains relatively strong. The stable core CPI is mainly attributed to strengthening global gold price at +8.8% yoy (+3.3% yoy in Apr23) as it will potentially affect the jewelry made of gold price. In addition, we see that the imported inflation may have a low pass-through effect since the Rupiah is still appreciating by +3.9% YTD and will likely to be stable in the subsequent month as the oil import will likely to be contracting. We expect the oil import to be at c.US$2.2bn (c.15% lower than Eid festive month), mainly from normalizing global oil prices by -34% yoy (-22% yoy in Apr23). Furthermore, we expect unchanged subsidized fuel price this year, which shall support the household purchasing power until year-end.

Unchanged BI rate in Jun23, but possibilityofBI rate hike in 2H23

We are on the view that BI may keep its policy rate unchanged at 5.75% in Jun23 amid benign inflation and stable currency. However, we believe that BI rate increase may be necessary in 2H23 in order to guard macroeconomic stability via the interest rate parity with the FFR and other EM countries. Currently the spread between the BI rate and the FFR is at 50bp (vs. 360bp in pre-pandemic times), which may post a high capital reversal risk should there be an episode of global economy turmoil. In the meantime, other EM such as India and Philippines already increase their benchmark rate by 50bp and 75bp respectively since Dec22.

Sumber : IPS