MacroInsight / Click here for full PDF version

Author(s): Luthfi Ridho ;Sevi Vinastya

- We estimate headline CPI to be at c.+0.17 mom/+2.26% yoy in Sep23 (-0.02% mom/+0.13% yoy in Aug23) mainly due to higher FnB cost.

- Rupiah depreciated by -0.7% mom/-2.4% yoy to Rp15.4k/US$ in Sep23, while YTD appreciation was only at +0.8% YTD (vs. +2.2% in Aug23).

- BI rate may be kept unchanged in Oct23 meeting but we still expect 25bp hike to c.6.0% in c.Nov/Dec23 mainly for interest rate parity.

Expect higher mom headline CPI

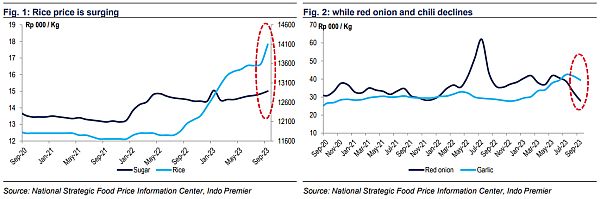

We expect headline CPI to be at c.+0.17% mom/+2.26% yoy in Sep23 (-0.02% mom/+3.27% yoy in Aug23) mainly due to higher FnB prices. Higher fresh food price was led by persistently high rice price at c.+3.7% mom/+17% yoy in Sep23 (+0.4% mom/+14.8% yoy in Aug23). Likewise, sugar price also rose by +1% mom/+3.5% yoy (+0.7% mom/+2.1% yoy in Aug23). However, this was mitigated by other fresh food prices which drop by c.-3.8% mom/-2.1% yoy. In sum, we expect headline CPI to decelerate in 4Q23 from high base effect from the subsidized fuel price increase in Sep22.

Prolonged elevated rice price on supply side issue

We see that elevated rice price was mostly due to supply-side constraint as El-Nino is predicted to prolong until c.Dec23, before the starting of the initial rainfall in Jan24. Moreover, BMKG implied the El-Nino impact will be amplified during dry season in c.Sep-Oct. However, government has intervened the rice supply issue with a total of 1.4mn tons new supply from imports and starting the government rice aid program for poor people in Sep-Dec23 amounting roughly 210k tons/month.

Higher restaurant & logistics cost

We expect a pick-up in restaurant and logistics price due to higher raw materials prices estimated at c. 4-6% and higher logistics cost at around 8-10% from non-subsidized fuel prices increase by 13.2% in avg. Meanwhile, we see transportation category to remain stable as we expect lower airline fares at around 25% mom from low demand seasonality in Sep23. However, risk may come from higher jet fuel prices by c.+8.6% mom (+5.6% mom in Aug23).

Core CPI to slightly decelerate but remain within the target range

We expect core CPI to be at c.+0.1% mom/+1.97% yoy in Sep23 (+0.13% mom/+2.18% yoy in Aug23). Our reading suggests still challenging households' spending appetite since individual savings still rose by +5.2% yoy (+4.6% yoy in Dec22). However, the global gold price acceleration by +0.2% mom/+14.4% yoy (-1.6% mom/+8.8% yoy in Aug23) may translate into higher jewelry made of gold that may adversely impact the core inflation. Nevertheless, we expect spending appetite to accelerate in upcoming months on more intense election activity.

Expect unchanged BI rate in Oct23 but still expect 25bp hike in Nov/Dec

We see the BI rate to be kept unchanged at 5.75% in Oct23 meeting on declining inflationary trend. However, we see that risk may come from Rupiah that already depreciated by-0.7% mom/-2.4% yoy to Rp15.4k/US$ in Sep23. For now, we keep our BI rate expectation at c.6.0% (another 25bp hike in c.Nov/Dec23) to guard the macroeconomic stability via interest rate parity.

Sumber : IPS