Company Update / IJ / Click here for full PDF version

Author(s): Ryan Winipta ;ReggieParengkuan

- reported US$263mn NP (+33% yoy) in 9M24, above ours but in-line with consensus forecast (87%/74% IPS/consensus).

- In 3Q24, NP stood at US$78mn (+21% qoq/+46% yoy) as operational volume improved following latest 8M24 data disclosures.

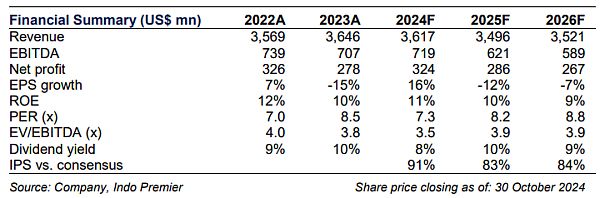

- We fine-tuned our FY24F forecast by +5% but maintain our Hold rating and kept our TP of Rp1,500/share. is trading at 7.3x FY24F P/E.

3Q24 review: robust distribution & transmission volume lifted NP

reported US$263mn NP (+33% yoy) in 9M24, above our forecast but in-line with consensus (87%/74% IPS/consensus), the result is above our NP forecast as actual distribution volume YTD has been better than our assumption, but was in-line with consensus forecast. In 3Q24, NP stood at US$78mn (+21% qoq/+46% yoy) on robust operational volume across businesses as revenue improved by +10% qoq, albeit gross profit declined by 8% qoq. Opex optically declined significantly in 3Q24 to US$24mn, but this was mainly driven by opex item (allowance for impairment losses) that is being reclassified into other expenses. Aside from that, there were no extraordinary item below operating line; effective tax rate also stood at 22%.

Revenue: decline in Saka & transmission, robust gas trading sales

In 3Q24, gas trading revenue grew by +19% qoq to US$680mn, while transmission and Saka Energi reporting -44%/-14% qoq decline in revenue due to lower toll fee and lacklustre upstream volume (~11% qoq), as per our estimates. On distribution side, albeit yet to be disclosed, we estimated +7% qoq volume increase to c.880bbtud in 3Q24 due to additional arrival from 1 LNG cargo in Sep24 while transmission volume was relatively flattish on qoq basis. Relatively strong distribution volume qoq is driving the revenue growth in gas trading, in our view. On other businesses, LNG trading revenue stood out at US$68mn (from US$31mn in 2Q24), following two LNG cargoes delivery from Petronas Malaysia to Chinese buyers.

Maintain Hold rating with unchanged Rp1,500/share TP

We fine-tuned our FY24F NP forecast by 5% as we take into account potentially strong distribution revenue & volume, especially with additional LNG cargo arriving in 4Q24F to cushion the decline from piped-gas. Moreover, we also adjusted down our assumptions on Saka Energi, following lower upstream volume up until 8M24. Our TP is kept unchanged at Rp1,500/share and maintain our Hold rating as overall result was already in-line with market/consensus expectation.

Sumber : IPS