Strategy Update / Click here for full PDF version

Author(s): Jovent Muliadi ;Anthony

- JCI/LQ45 dropped by -3% WTD (-0.4/-9% YTD) mainly on the back of US election and the concern on higher tariffs along with stronger US$.

- 3Q earnings growth was relatively decent but not enough to spark investors' confidence. FY25F earnings of mid-single digit are also muted.

- Despite valuation getting attractive, we believe it's best to stay on the side-line for the time being until clarity emerges.

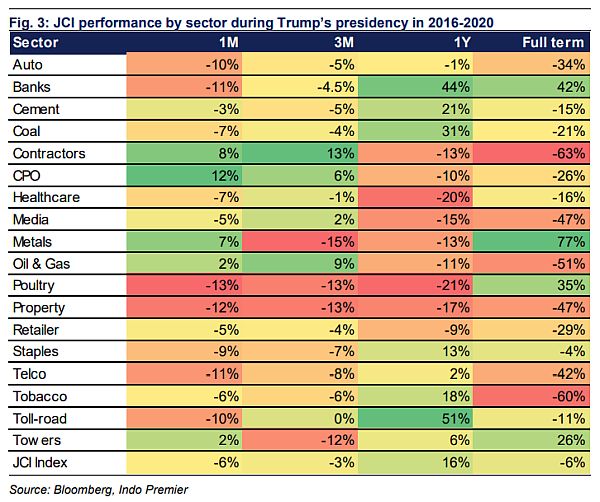

Steep sell-off amid external factor; Trump's presidency is -ve for JCI

JCI/LQ45 dropped by -3.5/-2.8% WTD (-0.4/-8.6% YTD) on the back of US election especially on the concern of higher tariffs which shall ultimately lead to higher inflation (higher for longer rate) and stronger US$.Consequently, during the last Trump's presidency JCI/banks dropped by -5.9/-10.6% in 1M period (-3.2/-4.5% in 3M period).Nevertheless our biggest concern lies on the potential of RMB devaluation as a retaliation against punitive US's tariffs- note that the last time China did RMB devaluation back in 2015 resulted in depreciation of Rupiah by 8.4% from Rp13,551 to Rp14,693 against US$ and sell-off in JCI (-12% in 2015).

3Q result was decent but not convincing

Overall stocks under our coverage posted 3% yoy earnings growth in 9M24 (+1% qoq in 3Q24) with only property and auto came above our expectation while tobacco and retailers came below; rests are in-line. This, in our view, doesn't spark investors' confidence in earnings recovery.We project JCI next year to generate 7% earnings growth, lower vs. S&P projected earnings of 13% and NIFTY 16%.Combined with domestic factor uncertainty and weaker US$, this makes JCI risk-reward unattractive, in our view.

Domestic noises may also exacerbated the current external pressure

Contrary to 2016 where domestic issue was relatively muted as most of the post-election noises in Indonesia have happened in 2014 and early 2015 i.e. lower cement price, lower KUR interest rate/noises on banks' high interest rate and NIM, toll-road tariffs discount, etc.We believe that this time is totally different considering that Indonesia also held the election on the same year with the US and as such, a lot of the noises has only started to emerge i.e. 1) government intention to lower cement price for cheap housing program (link) and 2) MSME loan amnesty program (link).

MSME loan amnesty program shall hurt but details are limited

Government recently approved the amnesty for MSME loan that can't be collected for at least 5 years (this loan has been provisioned and written-off, as such no direct impact to PnL) for the loan size of up to Rp500mn. This shall impacted the future recovery potential for the most given the MSME exposure (micro/small accounts 64% of loan) and sizable recovery (Rp18tr or 12% of total income vs. /BMRI/BBNI of 1/6/8%).However, given the limited details of the regulation, we haven't been able to assess the earnings impact. Bottom-line, we view that this shall exacerbated investors' weak confidence on .

Inevitable short-term pain along with increase in tail-risk for SOEs

We expect a ST pressure from both domestic and external factors. We also have a concern on the formation of Danantara (aiming to form a super holding to lever up) which potentially shall lead to higher overall debt/GDP, ultimately impacting market's liquidity and potentially currency. Despite appealing valuation as JCI/banks ex- trades at 11.7x/9.8x P/E vs. 10Y average of 16.6x/12.2x,we think it's best to stay on the side-line for the time being while awaiting clarity on: 1) Trump's tariff plan, 2) EGM agenda for SOE banks - this is imperative as it also increase the risk of kitchen sinking, if any and 3) details on MSME loan amnesty program. This is imperative, in our view, as it suddenly raises the tail-risk of SOEs especially. Domestic consumption may be considered safe haven for now.

Sumber : IPS