Strategy Update / Click here for full PDF version

Author(s): Jovent Muliadi ;Anthony

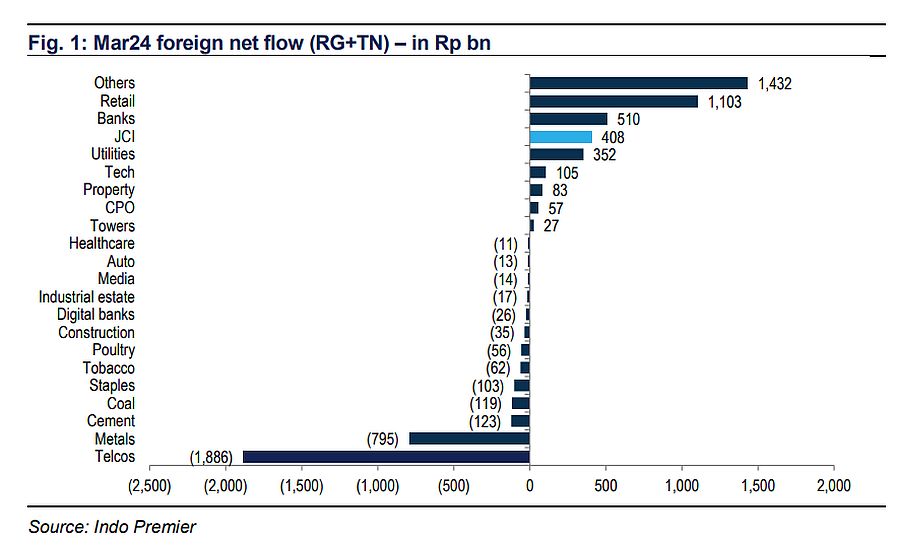

- JCI recorded a total foreign inflow of Rp408bn in Mar24 (banks at Rp510bn). YTD foreign recorded Rp13.5tr inflow (Rp14.3tr to banks).

- Other big caps however, experienced massive outflow i.e. at -Rp1.85tr in Mar24 alone while at -Rp2.9tr YTD.

- Given the huge inflow to banks YTD and in FY23, we think the MTD outflow may sustain amid disappointing 2M24 results.

Mar24 flow: tapering flow to banks; huge inflow to

JCI recorded a total foreign inflow of Rp408bn in Mar24. Most of the flow went toward banks but at slower pace of +Rp510bn (vs. +Rp6.3/7.4tr in Jan/Feb24) which probably due to dividend payment and muted Jan24 monthly results (see 1M24 results recap here). Nevertheless, banks still outperformed the sector at +1.7% mom. Biggest outflow and underperformer was telco at -Rp1.9tr (-10% mom, solely from ), a reversal from +Rp1.4tr (+3% mom) in Feb24. We suspect this was because of investors' concern on another price war following disappointing results (see our comments here).

YTD flow of Rp13.5 was entirely went to the banks

Overall JCI booked Rp13.5tr of inflow YTD. We observed that foreign inflow remains concentrated on banks at +Rp14.3tr YTD vs. +Rp11.3tr in FY23. We believe this was attributed to its robust FY23 performance at +22% yoy earnings growth as compared to JCI ex-tech and banks at -9% yoy. Other than banks, telco, towers, and digital banks also recorded a small inflow of +Rp220-370bn YTD. Both auto and metals experienced the biggest outflow YTD at -Rp2.9tr () and -Rp1.3tr ().

JCI performance was generally lacklustre in YTD basis

JCI booked flat YTD return (up to end of Mar24) while the outperformance came from banks +11% YTD, followed by coal at +9% YTD. However, auto booked -9% YTD return while telco at -7% yoy. Both staples and retails also booked negative return of -3% and -1% YTD. Tech seems to biggest drag on JCI at -14%, at -20% YTD amidst concern on the selling pressure from Alibaba along with disappointing FY24 guidance.

Expectations has been low for certain sectors and may be a better pick than banks for now

Banks generally has been the stalwart sector for JCI but recent 2M24 results has thus far been disappointing especially on margin (across all banks due to tight liquidity) and CoC (in BRI) -link to our note. We think the chance of big reversal in 1Q results to be relatively limited; combined with the fact that banks have been generating inflow of c.Rp25.3tr in FY23 and 1Q24 combined (BRI/BBNI had Rp9.9/4.5tr of inflow or 1.1/2.1% of market cap in 1Q24) also elevates the risk of flow reversal. As such, this shall beg the question which sectors to play going into 2Q.While we continue to like and (link), we also like telco (/EXCL) as we think the concern on price war seems to be relatively premature for now. Further, we also like consumer names (i.e. /MYOR) given that 1Q results may surprise on the upside supported by election spending and Eid festival - worth noting that last year's Eid festival was a disappointment. Lastly, we continue to like both and assuming the selling pressure from Alibaba has subsided.

Sumber : IPS