Company Update / Telecommunications / IJ / Click here for full PDF version

Author(s): Jovent Muliadi ;Ryan Dimitry

- 9M24 core profit came in at Rp18.6tr (-5% yoy), which met our estimates (71% of our FY24F vs. 3Y average of 73%).

- EBITDA declined by -4% yoy in 9M24 - also in-line with ours/consensus.

- 9M24 revenue grew by +1% yoy while decline in mobile ARPU qoq was also in-line with weak seasonality. Reaffirm Buy.

9M24 result was in-line ours and consensus expectations

reported 9M24 net profit of Rp17.7tr (-9% yoy), in-line with consensus' forecast at 73% (vs. 3Y avg of 73%). Core profit reached Rp18.6tr (-5% yoy) coming broadly in-line with our estimates at 71%. Revenue reached Rp112tr (+1% yoy) in-line at 73% of ours/consensus estimates (vs. 3Y avg of 74%).EBITDA reached Rp56.6tr (-4% yoy) in-line with ours/consensus estimates at 71/72%vs. 3Y average of 74%as EBITDA margin dropped to 50.5% (-263 bps yoy), reflecting a higher cash opex (+7% yoy) amid slower revenue growth.

Cellular revenue dropped due to soft purchasing power

3Q24 core profit came at Rp5.6tr (-21% yoy/-11% qoq) due to slowing topline growth. 3Q24 revenue declined to Rp36.9tr (-2% yoy/-3% qoq), as cellular revenue dropped to Rp20.6tr (-5% yoy/-3% qoq) due to soft purchasing power on top of weak seasonality. EBITDA reached Rp18.8tr (-9% yoy/+2% qoq), translating to a lower EBITDA margin of 50.8% (-396 bps yoy/+208 bps qoq) as cash opex increased qoq (+6% yoy/-6% qoq) driven by higher G&A expenses (+32% yoy/-15% qoq).

Slight decline in ARPU qoq; IndiHome B2C continues to add subs

Cellular subscribers declined to 158.4mn (decline of 1.5mn qoq) due to weak seasonality and soft purchasing power, while ARPU also dropped to Rp43.1k (-4% qoq). Meanwhile, IndiHome B2C continued to see a subs net add of +172k qoq, but ARPU declined to 239k (-1% qoq) amid introduction of lower priced products like EZnet.

Maintain Buy with an unchanged TP of Rp4,100

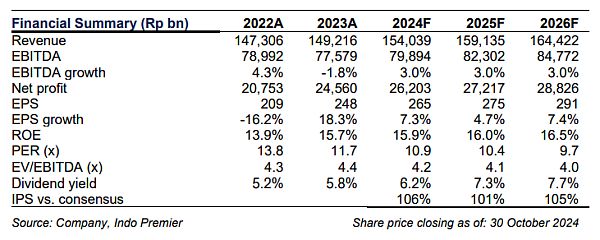

We await more details from earnings call (31stof Oct24), but overall 9M24 results came relatively in-line. Maintain Buy on , with an unchanged blended valuation-based (DCF and EV/EBITDA multiple) TP of Rp4,100. Risk is competition.

Sumber : IPS